Define Material Events With On-Demand Financial Quantification

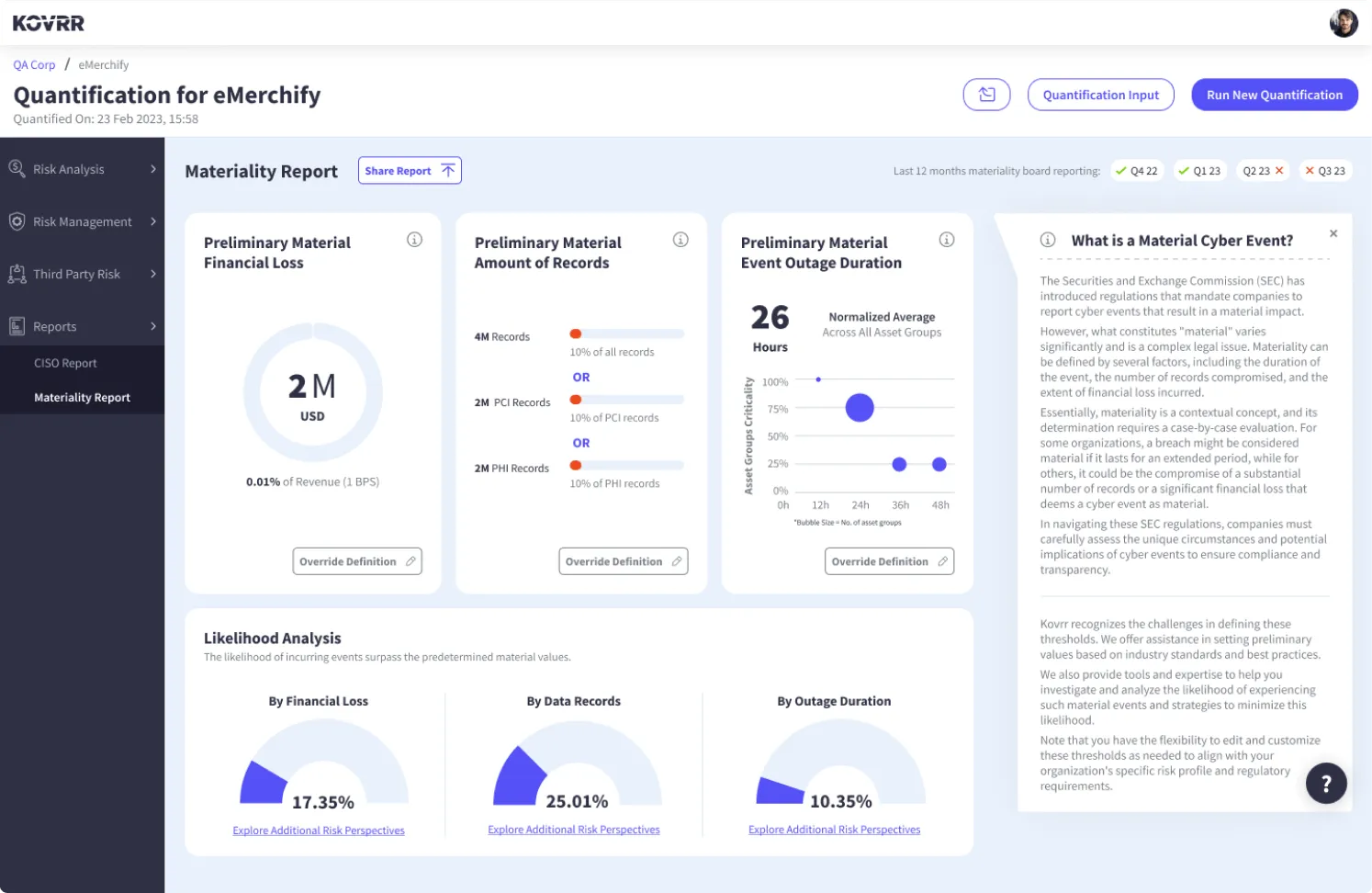

Kovrr’s scalable cyber risk quantification platform, combined with the innovative Cyber Materiality Report, illuminates baseline material cyber risks, arming organizations with data-driven insights to sharply define materiality and remain compliant with disclosure regulations.

Request a Free Demo Today

Why Define Materiality?

In the wake of the July 2023 SEC ruling S7-09-22, public US corporations are now tasked with disclosing material cyber events within four days of discovery. These corporations must also describe, in detail, their processes for assessing, identifying, and managing such material risks.

However, the SEC's broad definition gives way to various interpretations, pronouncing that materiality should be determined by the "substantial likelihood that a reasonable investor would attach importance" to the impacts of an incident.

Even non-US and private enterprises would benefit from clearly determining materiality regarding the impact of cyber events. Sharper definitions enable organizations to develop cost-effective cyber mitigation strategies that prioritize the most significant risks.

Determining Cyber Materiality With Kovrr

Given the unique nature of each organization, the SEC's ambiguous definition of materiality is appropriate. Factors such as industry, revenue, and geographic locations will shape internal thresholds.

Nevertheless, the term's subjective nature has generated new challenges for the CISO, C-suite, and boardroom members. Consequently, CISOs must ensure they can provide the data necessary for decision-makers to determine materiality.

That’s where Kovrr can assist.

4 Steps to Effectively Define, Manage, and Disclose Material Cyber Events

Kovrr's risk experts conducted a comprehensive analysis of corporations worldwide across various industries and concluded that the best practices for determining materiality begin with a basis point of revenue. Incorporating this baseline, Kovrr’s models evaluate millions of real-world cyber event data points, including external global threats and insurance loss intelligence, along with an organization's unique cybersecurity posture, to produce unbiased, highly calibrated risk and materiality assessments.

Once equipped with this objective data, corporations can easily visualize what constitutes a material loss, making the risk and governance reporting disclosures more straightforward. As such, Kovrr has devised a concise 4-step process to aid organizations in assessing their unique material cyber risks and formulating a practical plan for risk mitigation that can be documented in a timely manner.

Cyber Event Materiality Criteria Establishment

While Kovrr’s Cyber Materiality Report leverages a base revenue point, the solution also incorporates an organization’s respective criteria for determining materiality in regards to its unique business objectives and enriches it by further assessing the following parameters:

Risk tolerance

Risk threshold

Risk appetite

Financial impact

Insurance deductibles

Brand consequences

Data sensitivity levels

Operational interruptions

Legal repercussions

Event longevity

Stakeholder Identification and Engagement

Kovrr’s platform brings together the key stakeholders that will be directly involved in evaluating and determining a cyber event’s materiality. This group generally includes:

C-suite executives

Boardroom members

CISOs and security teams

Internal compliance personnel

Legal consultants

Kovrr also collaborates with these key parties during materiality criteria establishment. Cooperation among stakeholders is crucial for accurate, valuable, and transparent cybersecurity risk management, strategy, governance, and incident disclosures.

Risk Quantification and Materiality Report

Kovrr employs advanced simulation models and an extensive event catalog to identify an organization's likely cyber events. Simultaneously, our novel solution automatically plots the base revenue and extreme event points on a loss curve to highlight the organization’s most significant, most material risks in combination with the likelihood of experiencing that type of event.

Top risks

Event likelihood

Event severity

Event types

Attack vectors

Our models leverage these materiality thresholds and other significant criteria provided by key stakeholders in Step 1 and Step 2 to compute the probabilities of an organization experiencing a loss of that amount.

Continuous, On-Demand Cyber Risk Assessment

Kovrr offers on-demand quantification and materiality reporting, ensuring organizations can evaluate their cyber risk and determine which are likely to meet materiality thresholds, rendering them suitable and applicable for annual report disclosures.

Our risk models constantly evolve, adapting to and accounting for the latest cyber threat data and trends.

Regularly conducted risk simulations keep an organization informed of new material risks that might arise, creating substantial time to disclose incidents and develop robust management strategies.

Stay Aware. Stay Prepared.

The latest SEC rulings and other global cybersecurity regulations make it all the more critical for organizations to implement high-level processes to remain aware of potentially material cyber events. Don’t wait until after an incident has occurred to establish these instrumental procedures.

Request a Free Demo Today